What We Do

Market Opportunity

Airport Concessions are highly lucrative contractual rights to operate and provide in-terminal services to airport passengers. Today retail and restaurant concessions (our focus industries) generate approximately $12 billion in annual revenues in the US airports.

The concessions industry has a high degree of concentration in a handful of global firms. Today joint venturing between

a) these global firms, and

b) minority-owned partner firms

is the fastest growing form of airport concession structure in the US. This joint venture allows these Big Six global firms to meet US federally mandated set-aside ownership requirements for low-to moderate-net worth women- and minority-owned businesses while maintaining operational control of the concession. These set-aside requirements total approximately 30% of the domestic airport concessions market, but due to the federally mandated low- to moderate-net worth requirement (on ownership representing 51% control) this vast market is largely unbankable.

At Cougar Mountain Financial we offer savvy, accredited investors an opportunity to invest in pools of loans deployed to junior JV partners of these global firms to finance and execute airport concessions lease contracts. These contracts generate historically stable income streams which have proven resilient to market shocks affecting the travel and aviation industries. Our investments are collateralized by the underlying airport concessions contracts, representing a diversified in-terminal retail and restaurant portfolio, with predictable cash flows generated primarily by large-cap, global concessions firms.

The Big Six Primes

What Problem is CMF Solving?

Every year in the United States, airports award in-terminal concessions contracts requiring capital investments totaling approximately $550 million in the two segments of CMF’s focus:

- Retail – $5 billion annual revenues

- Food and Beverage – $7 billion annual revenues

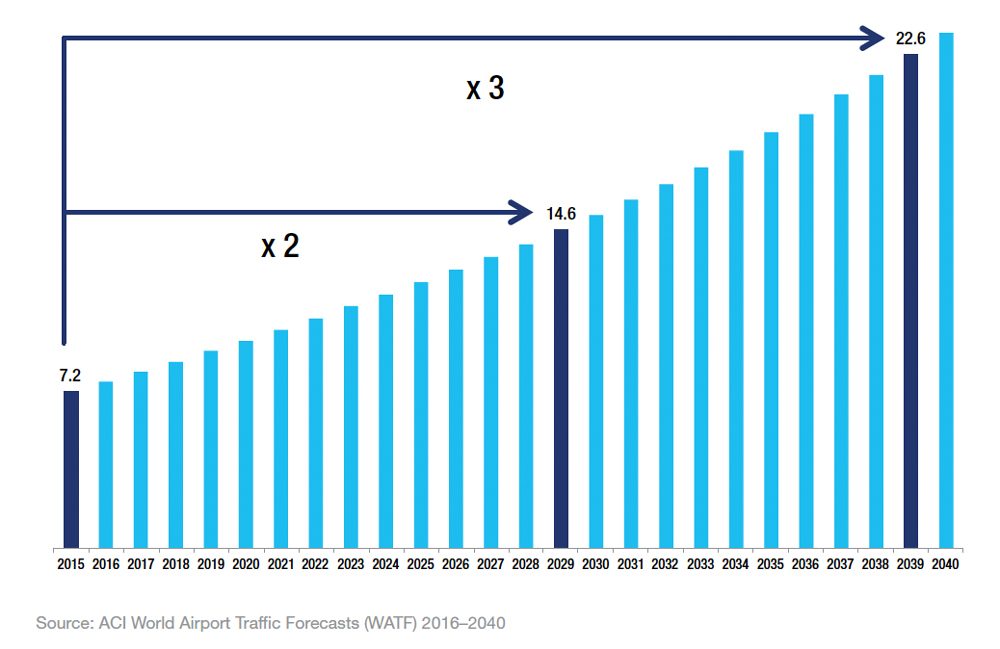

Revenue growth in these two segments is closely correlated to passenger enplanements.

- Annual growth in US enplanements at 4% in 2016 and 2017

- Forecast annual growth of 5.2% globally through 2040

- Enplanements consistently grow at a faster rate than US GDP.

Within the News & Travel Convenience and Food & Beverage concession sectors, US airports award new concessions with projected annual revenues totaling $1 billion in year-one. These revenues are then expected to increase thereon through the duration of a concessions agreement in tandem with long-term enplanement growth. A typical concessions agreement has a term of 7 to 10 years.

- All US airport concessions awards require federally certified low- to moderate-net worth junior partners whose participation totals approximately 30%.

- Built-in protections for junior partners ensure returns match those of Prime Concessionaire operating joint venture managers.

Airports Need Additional ACDBE Partners But Lack Of Capital Limits New Program Entrants

Federal Aviation Administration

Office of Inspector General

Audit Report

January 2017

View FAA Audit ReportEvery year, approximately $150 million is needed for firms certified as Airport Concessions Disadvantaged Business Enterprise (ACDBE) joint venture partners to provide capital for their share of the JV.

- Individual retail concession units have typical start- up costs ranging from $1.5 to $2.5 million;

- A 30% minority-partner needs to invest around $450k to $833k, per unit; and

- Many joint ventures consist of multiple concessions with anywhere from 2 to 20 units.

The Inspector General recently discovered that while the amount of concessions awarded to ACDBEs is increasing, the number of new certified ACDBEs entering the program is declining. This is directly attributed to the lack of financing options for new program entrants.

The shortage of finance alternatives is widely known:

- Traditional banks are unable to provide service to the sector due to restrictive banking regulations; and

- SBA loans are not permitted when the borrower does not control the operations.

As a work-around the Prime Concessionaire firms reluctantly make lender-of-last-resort loans to their junior partners. This type of Prime Concessionaire financing:

- Makes it difficult for the minority-partner to achieve the status of genuine independent partners;

- Is not desired by the Prime Concessionaire firms, who are not themselves in the lending business; and

- Is resulting in sub-optimal results of the Government’s ACDBE Affirmative Action program goals.

The CMF Solution

Cougar Mountain Financial operates as DBE Loans in the marketplace for sourcing loans.

- Recently, the trade press reported with great fanfare that there are an increasing number of new financing options available for cash-poor ACDBEs, including DBE Loans LLC.

DBE Loans LLC is the only one of these alternatives that is currently viable. Why?

- Our competitors act as investment bankers demanding equity from the ACDBE. This is considered exploitative within the concessions industry and has failed to gain traction.

- DBE Loans LLC provides more traditional banking products, ie variable rate loans over the first five years of the life of the concession. Due to its hands-on industry knowledge, DBE Loans has been able to work directly with Prime’s legal teams to create the legal conditions necessary for DBE Loans LLC to secure its loans against the ACDBE’s share of JV cash distributions.

- DBE Loans LLC provides term loans for no more than the first 5 years. This means cash flows from years 6 thru the end of the concession, which could be as long as 10 years, would be available to repay any unpaid principal that was due within the first five years. As is standard banking practice the interest rates on such late payments are substantially greater than the rates we charge during the scheduled life of the loan.

- The history and position of Marques Warren, President and CEO of CMP, within the minority airport business community provides a unique access point to this borrower group and is a source of sustainable competitive advantage. Trust is “currency” within this tight-knit community of minority entrepreneurs. As a second-generation ACDBE, Marques has achieved a high degree of credibility and is held in high esteem.

Data-Driven Risk Management

Concession-Backed Securities™

CMF offers Concession-Backed Securities™. This is debt backed by the future cash flow streams derived from the rights to operate the concession.

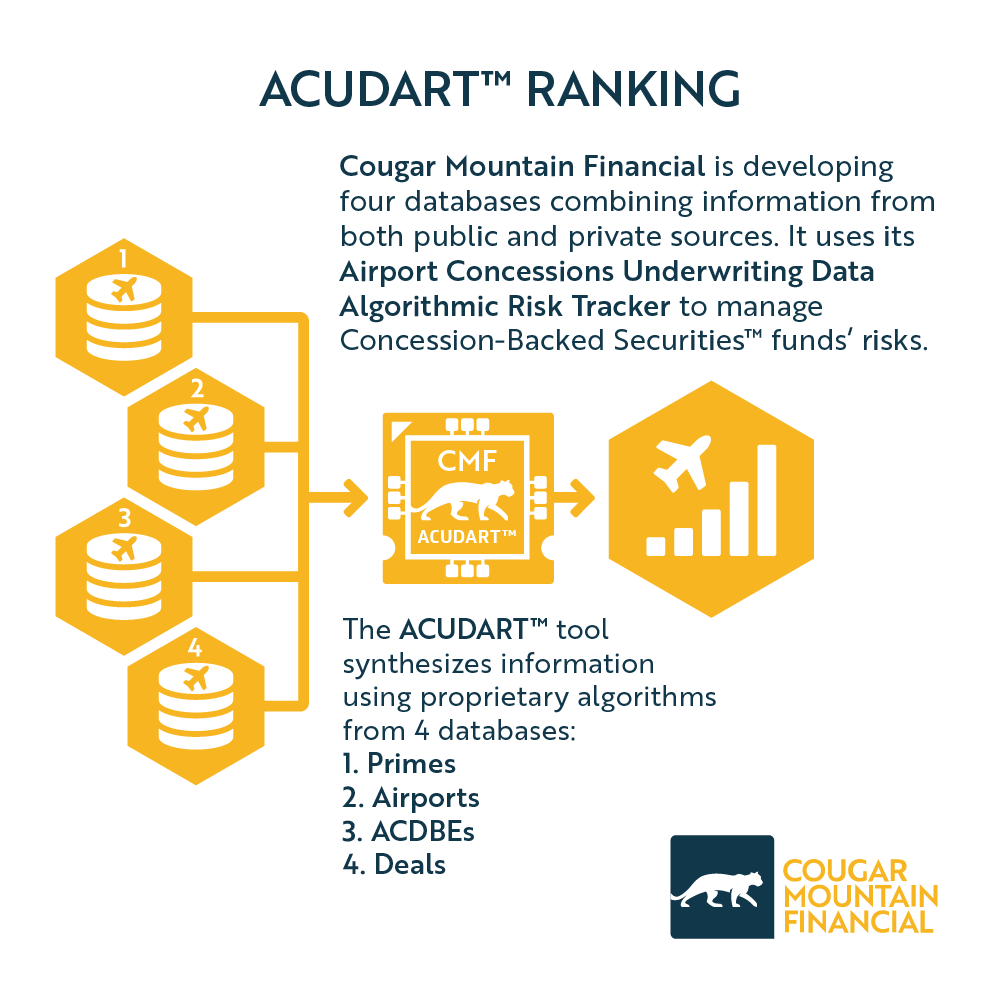

CMF is currently developing a proprietary ACUDART™ tool to help manage risk inherent in the underlying concession cash-flows.

- Information from these databases is synthesized using proprietary algorithms to identify risk factors and risk mitigation.

The end-product is an overall rating of the specific deal we are considering financing.

- At the fund level, risk is further reduced by pooling a number of high quality, highly rated concessions with some diversification among primes, ACDBE borrowers, brands and airport locations.